does florida have capital gains tax on stocks

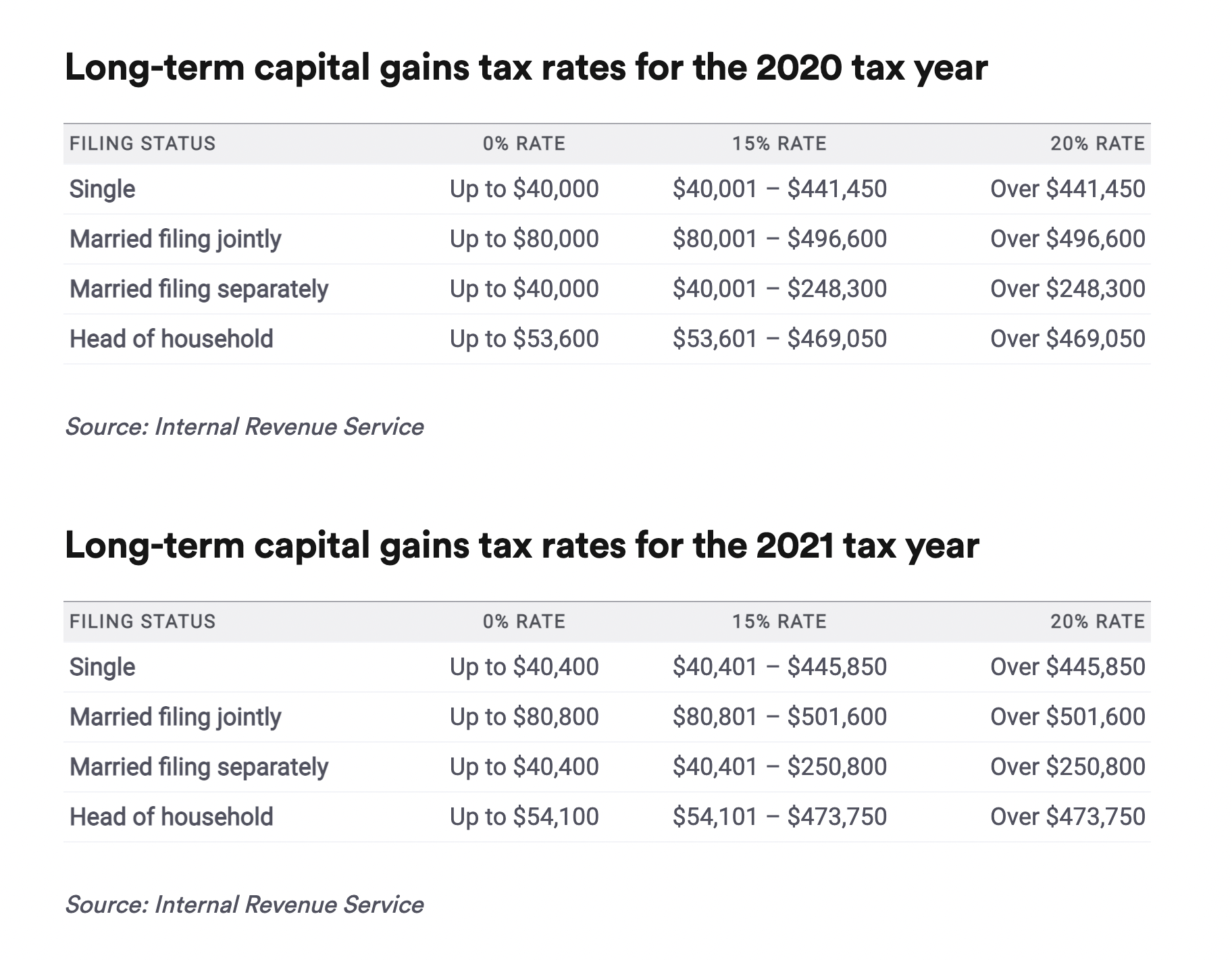

Web Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year. However you must send federal capital gains tax payments to the.

Guide To The Florida Capital Gains Tax Smartasset

Web The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

2.png)

. Web Therefore if you receive capital gains in florida there is no tax regardless if section 1202 100 tax exclusion on capital gains from the sale of qsbs applies. Web Florida has no state income tax which means there is also no capital gains tax at the state level. Web For example if you are in the 24 marginal tax bracket and have a 1000 gain your capital gains tax would be 240.

There is currently no Florida income tax for individuals and therefore no Florida capital gains tax for individuals. Web Specifically New Hampshire imposes a 5 tax on dividends and interest while Tennessee charges a 6 tax on investment income in excess of 1250 per person. One year You must own a stock for over one year for it to be considered a long-term capital gain.

But if you live in Florida youll be responsible for paying federal capital gains tax when you sell your house. If you earn money from investments youll still be subject to the federal. Web Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year.

Web Filing and paying Florida capital gains tax isnt necessary since Florida doesnt have state-specific rules. Web Capital gains tax is a tax imposed on your capital gain which is generally computed as the amount you sold the asset less the amount you purchased it. Web Does Florida Have Capital Gains Tax.

Web Weve Got You Covered. Web Long-term rates are lower with a cap of 20 percent in 2022. Web If you have a portfolio and have sold any stocks at a profit this year you might be looking for a way to offset the capital gains taxThats where tax-loss harvesting.

The State of Florida does not have an income tax for. Web Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. 5 rows Does Florida Have Capital Gains Tax.

The tax rate youll pay depends on how long youve owned the. If your taxable income is less than 80000 some or all of your net gain may even be taxed at. Short-term capital gains are taxed at the same rate as your income.

Web Not All Profits Are Taxable. When calculating your taxable income theres no. At the federal level and in some states these.

Web However if you are in the 396 income tax bracket you will pay a 20 capital gains rate on your long-term capital gains. The state of Florida does not have a capital. For example if you buy a.

For single filers with income lower than 40400 youll pay zero in capital gains taxes. If you earn money from investments youll still be subject to the. If your income is.

Web The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. HMRC took a record 61 billion from the tax in. Capital gains are the profits you make when you sell a stock real estate or other.

Capital Gains Tax Exemption When selling your house in Florida you can exclude a high portion of your profits given specific conditions are met. Web Florida Department of Revenue. Web Florida has no state income tax which means there is also no capital gains tax at the state level.

No there is no Florida capital gains tax. Includes short and long-term Federal and. Web Changes to inheritance tax IHT have been publicly mooted as a way for the Government to increase its tax receipts.

Web The capital gains tax on most net gains is no more than 15 for most people. Web How long do you have to own a stock to avoid capital gains. You have lived in the.

Web Short-term capital gains tax rates on stocks. If you have a loss you can use it to offset. At the federal level and in some states these.

Capital Gains Full Report Tax Policy Center

Capital Gains On Selling Property In Orlando Fl

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Restricted Stock Units Jane Financial

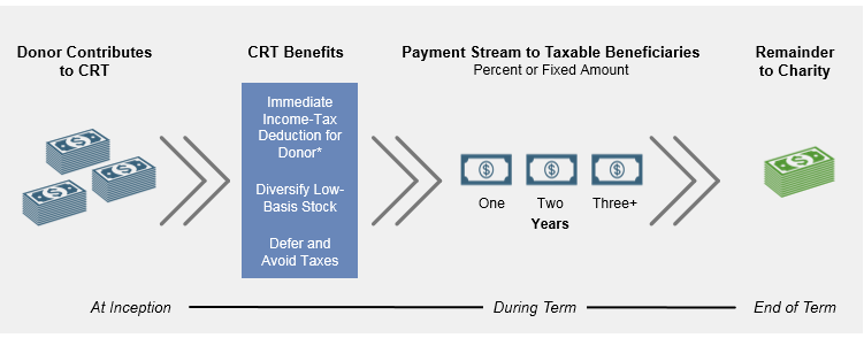

Charitable Remainder Trust Crt Florida House Dc

Capital Gains Tax In The United States Wikipedia

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Crypto Tax 2021 A Complete Us Guide Coindesk

Capital Gains Tax In The United States Wikipedia

2021 Capital Gains Tax Rates By State

Short Term And Long Term Capital Gains Tax Rates By Income

How Much Tax Will I Pay If I Flip A House New Silver

State Taxes On Capital Gains Center On Budget And Policy Priorities

Short Term And Long Term Capital Gains Tax Rates By Income

Real Estate Capital Gains Tax Rates In 2021 2022

Tax On Capital Gains While Receiving Social Security Benefits